A+ Rating

With the Better Business Bureau

$14 Billion

Delivered to Businesses Globally

The perfect

combo of speed and service.

And it’s easy to get started.

Step 1. Complete the application

Our application is pretty simple, and you can apply online or over the phone.

Step 2. Get a decision

Your dedicated loan advisor will review your options with you.

Step 3. Receive your funds

Complete the online checkout and receive your funds as soon as the same day.*

Your

business needs options.

We’ve got different loans available for you.

Onegem Financial Line of Credit

Use

for managing cash flow,

such as buying inventory

or making

payroll

Get

a revolving credit line,

with access to cash

when you need it

Loan amounts of $6K–$100K

12-month

repayment term, resets after

each withdrawal

Onegem Financial Term Loan

Use

for investments in your business,

such as

expansion projects

or large purchases

Get

a one-time lump sum of cash upfront,

with the option to apply for

more when you’re

halfway paid down

Loan amounts of $5K–$250K

Repayment

terms up to 24 months

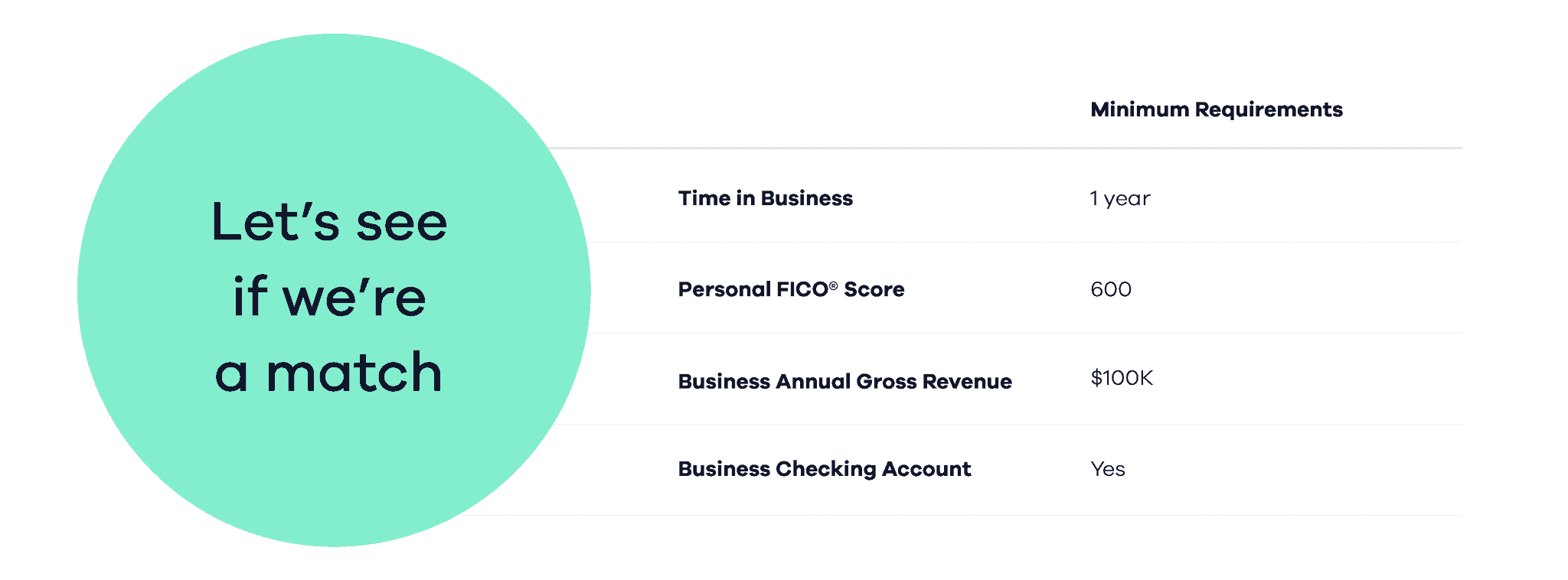

Minimum eligibility requirements for an Onegem Financial Term Loan or Line of Credit

Online doesn’t have to mean impersonal – with Onegem Financial you get real people to talk to.

Your dedicated, U.S. based loan advisor is available to help you every step of the way.

Monday – Friday

9:30 a.m. –

7:30 p.m. ET

Apply Online

* Same Day Funding is only available in

certain states, for term loans up to $100K. Eligibility window is

Monday-Friday before 10:30am EST. If checkout is done before

10:30am EST, funds will be available by 5pm local time the same

day. If checkout is done after 10:30am EST, or on a weekend or

Group holiday, it will not qualify for Same Day Funding and funds

will be deposited within 2-3 business days. Eligibility rules

around creditworthiness and length of term loan apply.

Eligibility

for the lowest rates is very limited, available only to businesses

with the strongest creditworthiness and cash flows, and typically

businesses that have shown an excellent payment history on prior

loan products with Onegem Financial . The average rate for term

loans is 62.1% APR and the average rate for lines of credit is

48.9% APR. Averages are based on loans originated in the half-year

ending March 31, 2022.